Manual data entry

Benefit and expenses records are assigned to a selected employee record within the system. The software will require a certain amount of information in order to calculate a benefit in kind value. The information required to be entered is particular to each section of the P11D.

System calculation/HMRC working sheet calculation

The following data points are used to calculate the benefit in kind for this benefit type:

- Total allowance received by employee (mileage x rate per mile)

- Total other expenses received by employee

- Less any amount made good or from which tax deducted

Step-by-step guide (manual data entry)

Select the employee record to that you wish to assign the benefit to then press the "Employee Benefits" button in the bottom right-hand side of the window.

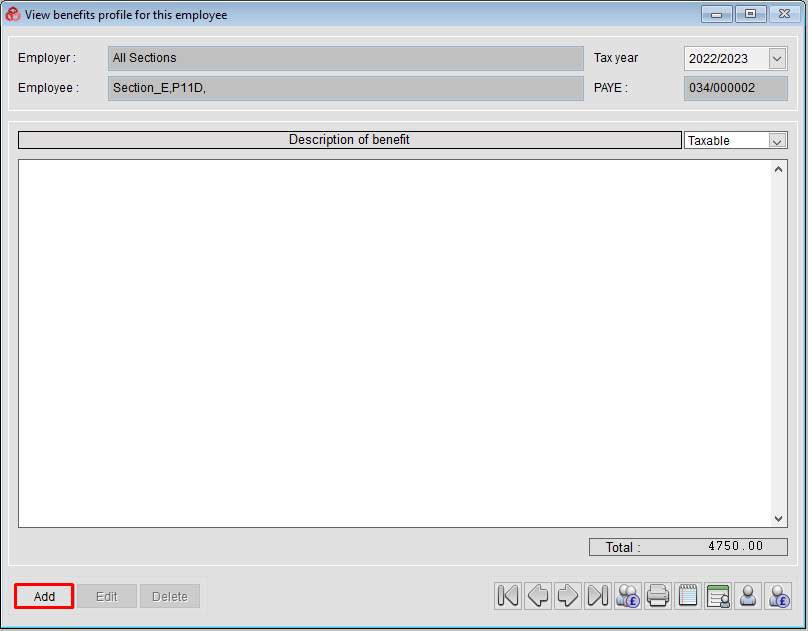

Click the ADD button.

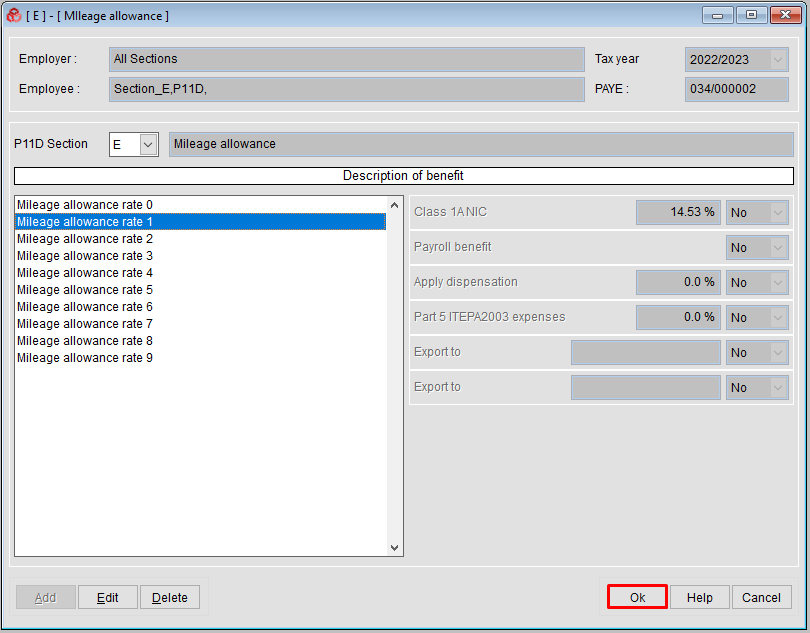

Select the desired “Description of benefit” mileage rate band to use and click OK.

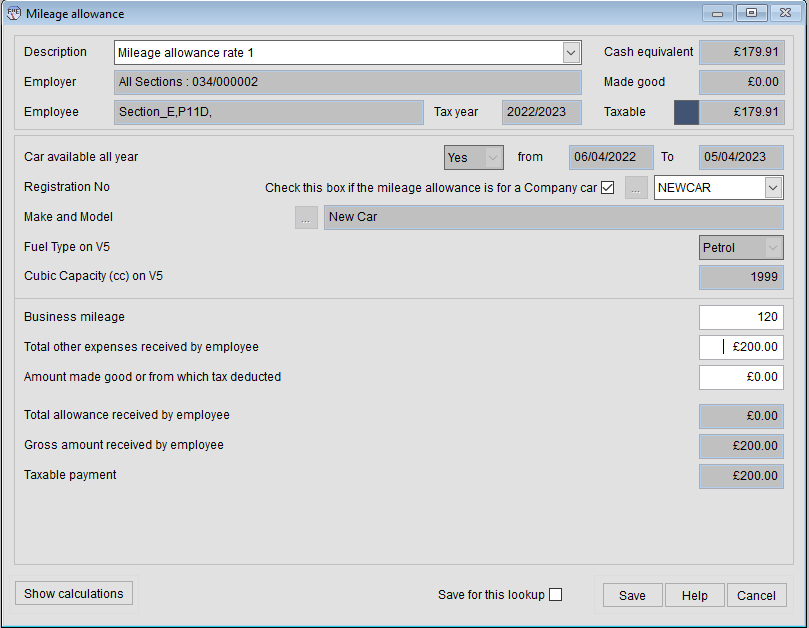

If the car in question is a company car, select the check-box to confirm the Mileage allowance is for a Company Car - The car reg number and details of the employees company car is displayed (this car is already assigned to the employee in Section F of P11D and WITHOUT PRIVATE FUEL benefit).

Enter the amount of business miles claimed and click SAVE

The saved record will be displayed:

Clicking Edit (if required) will allow you to enter the details of any other values relating to the benefit in order to allow the system to correctly calculate the benefit in kind value. This should include the total amount of money or expenses the employee has already received in reimbursement (including any amount "made good" then click SAVE to save the record.

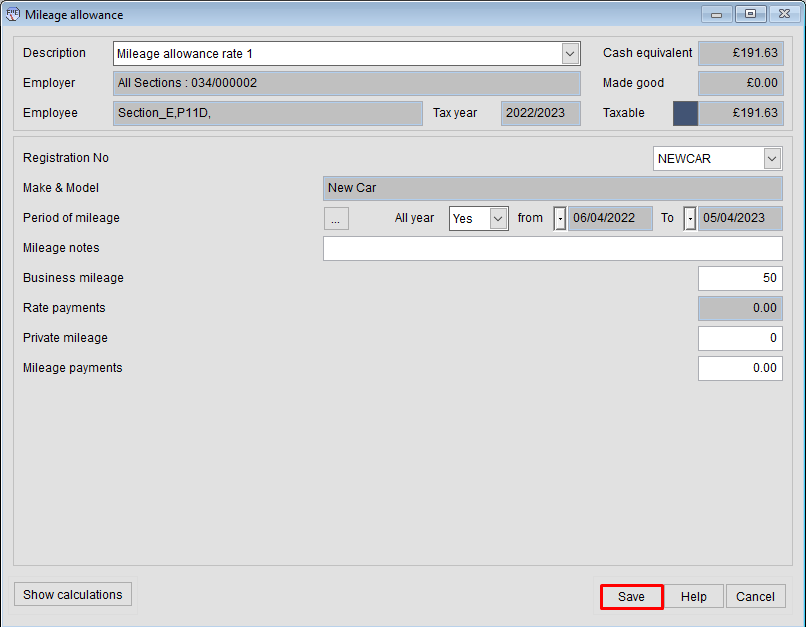

To add the “business mileage” claimed, Select the MILEAGE PAYMENTS tab and click Add

Enter the amount of BUSINESS MILEAGE claimed, along with any optional information for notes or private mileage and click SAVE to save the record.

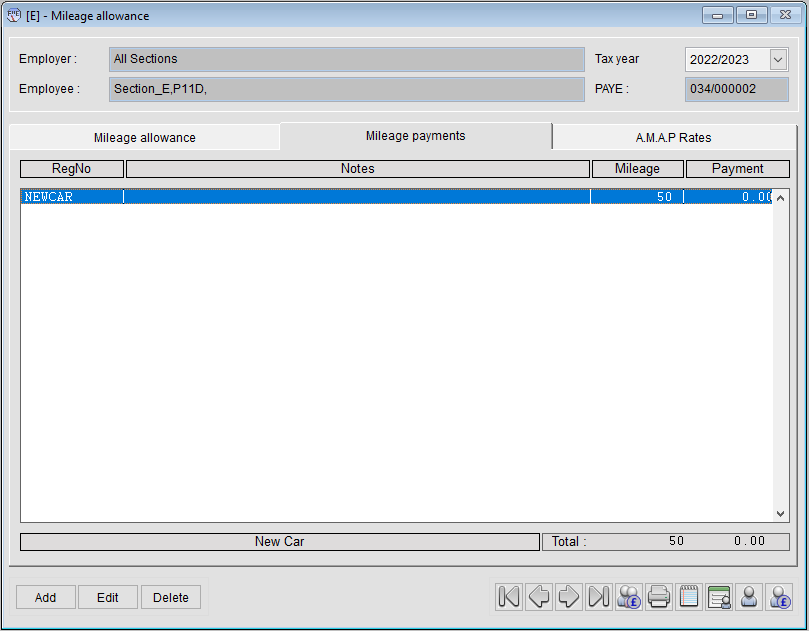

The saved Mileage details record will be displayed as below.

In order for the system to calculate the difference the employee has received compared to the agreed AMAP rates, you will need to set a table of the rates your company pays.

Clicking the A.M.A.P. Rates tab will display the record as it currently compares with the approved HMRC AMAP rates, in the example below, a negative -£8.37 tax relief position is displayed as the system has not yet been set to use the actual mileage rates paid by the company for business mileage of a Company car.

To set the company mileage rates correctly to reflect the actual rates paid to company car drivers...

Select TOOLS, then SETUP BUSINESS MILEAGE RATES from the toolbar

Select the Mileage rate to use from the drop-down “Type of car” (e.g. Mileage allowance rate 1) and click ADD

Enter the values in the engine capacity fields (e.g. 0 to 9999) and the rates paid both up to and over the 10,000 miles break (e.g. 20p up to 10000 and 18p over 10000) & OK to save

Click on OK to save the rate table you have created (a confirmation pop-up will show to confirm the recalculation)

The record entered previously will now have been recalculated based on the table of rates that you have successfully saved:

Clicking on the “AMAP Rates” tab will show that there is a Taxable benefit for the example we have entered when compared with the HMRC Advisory Fuel Rates when it relates to mileage performed in a company car.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article